- What we do What we do

- How we can help How we can help

- Insights Insights

- About About

- Support Support

- Book a Demo

HMOs: the next growth driver for BTL lenders

In an era of historical low interest rates, lenders have been looking to innovation to drive revenue, with the number of new BTL mortgage products on the market at an all time high. However, with so many competing products available, and in a broker-led marketplace, leading lenders have been looking to new segments to fuel growth. For those with the right expertise and approach, the higher risk, higher return segments such as HMOs represent a substantial opportunity.

For many lenders, HMOs still represent something a bit grubby: student digs or low budget homes just one step above a hostel. Not only do such properties come with increased risks of arrears, they also come with the potential to damage reputations. If a prestigious lender wants to avoid being featured on a Paul Shamplina TV show, then such investments are best avoided.

Yet new data shows that this impression is substantially out of date, maybe even detrimentally so when it comes to considering the growth opportunity that these higher yield, higher value properties can represent. The key to unlocking this challenge is expertise. It takes expert landlords to thrive on the challenge of higher risk, higher reward properties. With the right expertise, lenders too can take the opportunity to invest, after an effective assessment of the risks involved. With legislation on the rise, uncovering the compliance status of properties in this more regulated market segment is key to supporting the education of landlords.

Statistics from Mortgage for Business show that since the first half of 2018 the gross yield of an HMO has increased from 8.6% to 9.6% in 2019, compared to standard buy-to-let which only increased by 0.3%. We also see a great difference in the end of 2020 with 9.13% for HMOs compared to 5.69% average growth yields for standard buy-to-let properties.

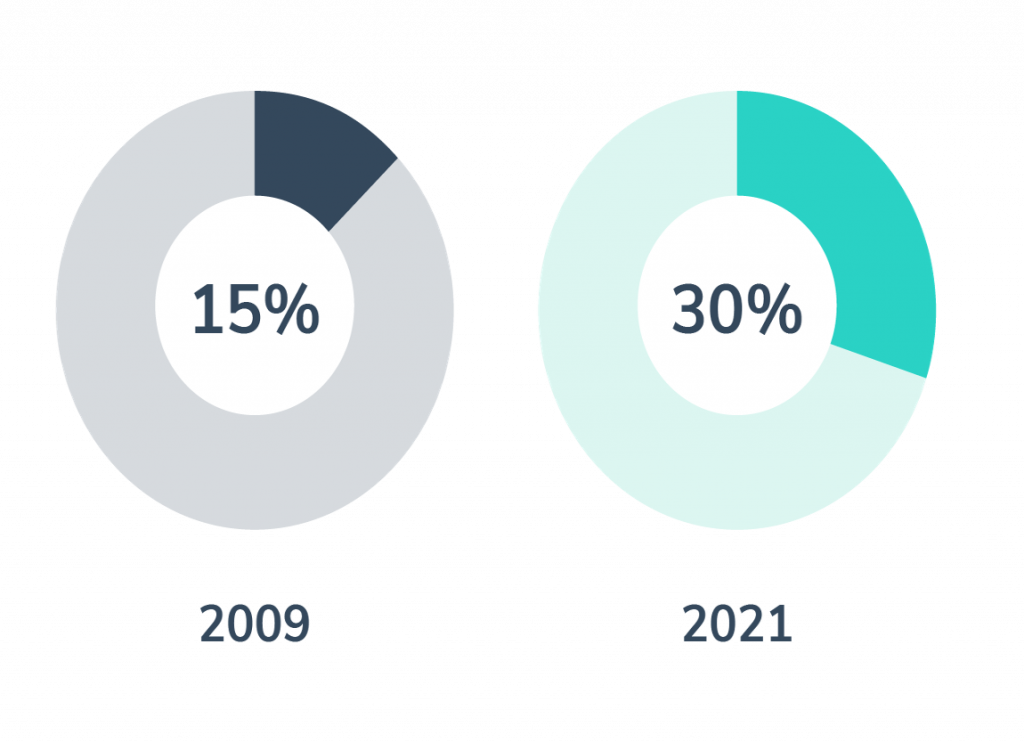

Expert landlords: The increasing professionalisation of the sector

One driver of change in the HMO market has been the changing profile of landlords themselves. In part this is driven by lenders’ own policies that ensure first time landlords can not easily borrow on more complex projects, such as HMOs. Or that a landlord’s full portfolio revenue is considered before offering an additional loan on a new property. Through effective gatekeeping, lenders have ensured that only seasoned landlords with balanced portfolios have been able to enter the HMO market. This has led to a growing segment of higher skill landlords that are able to deliver on higher yield opportunities and can afford higher mortgage premiums.

The second big driver is government tax changes that have driven many landlords out of the sector altogether. The removal of mortgage interest relief in income tax calculations has led to more professional landlords than ever before setting up as limited companies, whilst increased stamp duty or additional properties has made it harder to turn a profit on investments. Those who were struggling before changes in tax law may have left the sector altogether whilst those with revenue to protect and enough expertise have taken the next step in becoming whole businesses.

“There were 41,700 new companies formed in 2020 – an increase of 23 per cent on 2019” – Hampton International.

Evidence of this change of profile and change of focus is not hard to find. HMO landlords today appear to be part developers, part graphic designers, part property managers, able to see value where others don’t and generate significant return on their investments. The opportunity to work with high performance business people who know how to effectively sweat their assets should be welcomed by the lending sector, something that specialist lenders have known for a long time.

Higher reward and higher risk

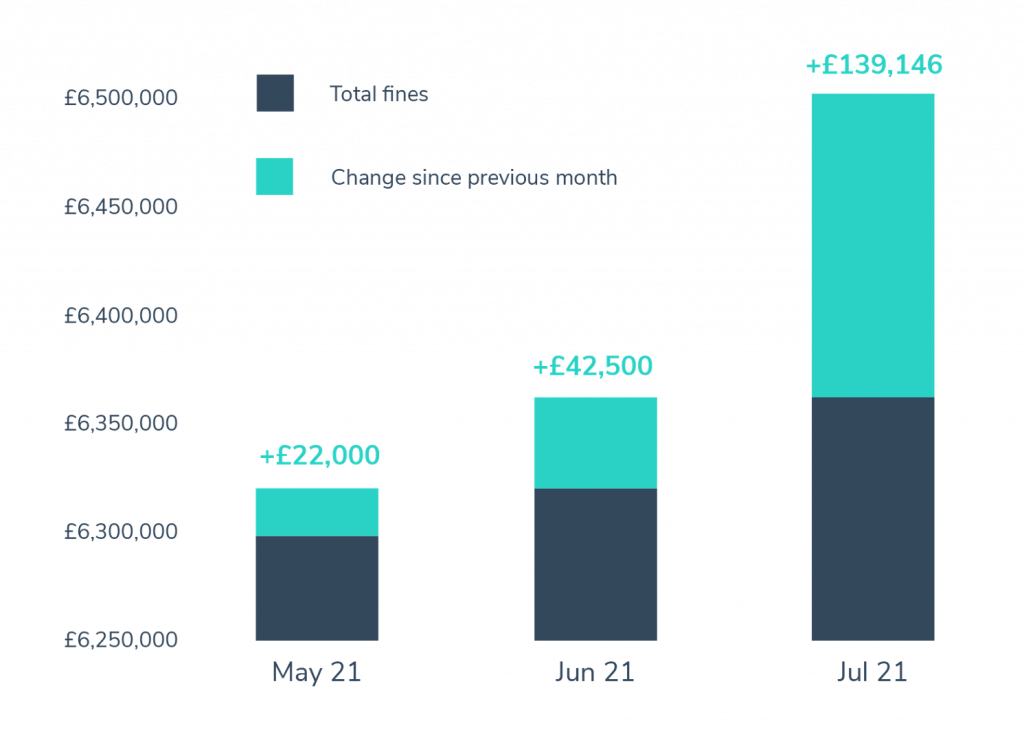

This isn’t to say that the sector is wholly without issue. Ever changing compliance regulations with both national mandatory licensing schemes and supplementary local additional schemes add complexity. There is also evidence that cash strapped councils are starting to consider more aggressive enforcement as a way to generate more cash for property management. The increasing risk of fines is a major threat to the profitability of HMO landlord portfolios, and brings real risk of arrears. Fines for PRS non-compliance in London, recently hit £6.6 million, driven by a more aggressive approach in local authorities such as Coventry, Camden and Newham.

It also needs to be well understood that these fines are not distributed without cause. Rogue Landlords are still a blight on the industry and are particularly active in the HMO sector. Data from the Mayor of London highlights both the challenges for lenders in maintaining standards in the sector, and a more aggressive approach taken by some local authorities who use licensing as a way of policing the sector.

Data-driven lending: unlocking this higher yield segment whilst managing risk

Lenders too can lean on this process, using licensing to identify rogue landlords and, by doing so, play a huge role in supporting standards within the sector. Landlords that are remortgaging and already have a licence will have passed council inspection and are far less likely to be ‘rogues’. Where new or changing legislation carries risk for unaware landlords, lenders can play a leading role in educating them. Providing expertise at the originations stage carries many benefits for lenders. Being able to deliver a clear and unambiguous update on the current and future licensing requirements of a BTL property differentiates the lender from the competition, improves the customer offer, and reduces risk.

In short then, this is an area of high demand and high yield for lenders and it doesn’t need to be higher risk. Lenders actually have more data in this area than in others and can make exceptionally well informed decisions about the HMOs they lend on. The complex legislation and compliance status of the property can actually feed into how they price and value a transaction. Nor does it need to be a labour intensive process. The information is available upfront and in real-time. Becoming a more informed leader even supports broker relationships as both speed and certainty of completion improve. With the segment growing, and more HMO products in the market than ever before, the opportunity to drive lender growth through this new segment is both large and competitive. Supporting this burgeoning market segment through compliance complexities is one way leading lenders can stand out.

Join our expert panel discussion featuring Landbay’s Paul Clampin, Rightmove’s David Cox and NRLA’s Chris Norris this week to learn how to use expertise to unlock the HMO opportunity.

How EPC data impacts property valuation for mortgage lenders

Reliable and up-to-date energy efficiency data is a must to ensure an accurate property valuation for UK mortgage lenders – here’s why.

Read more

New insights: how does EPC data impact affordability assessments?

Accurate energy performance data is a must to ensure mortgage lenders can accurately assess affordability and reduce risk – here’s why.

Read more

Kamma’s Response to CVE-2024-0394 (XZ Utils Backdoor)

Last week security researchers publicised a malicious back door in the XZ Utils library, a widely used suite of software that gives developers lossless compression and is commonly used for compressing software releases and Linux kernel images. The backdoor could, under certain circumstances be used to run unauthorised code via the encrypted SSH connection protocol. […]

Read more

Subscribe to the Kamma Newsletters

Regular news, information and insights from Kamma. No spam. Unsubscribe at any time.

Subscribing ...

Sorry, we really want to but we couldn't subscribe you due to missing or incorrect information; please update the information that's highlighted in red and try again.

Well this is awkward. Something went wrong on the internet between your browser and our newletter subscription service. Please let us know and we'll do our best to fix it for you.

Thanks for subscribing! Check your Inbox in a short while for a confirmation email to check it was really you that just subscribed. If you've already subscribed, we'll keep your subscription but you won't receive a confirmation email this time.