- What we do What we do

- How we can help How we can help

- Insights Insights

- About About

- Support Support

- Book a Demo

Getting the best possible valuation for your letting agency

Selling a business is never easy, and often means running the process to attract and negotiate with a buyer whilst still running the company to ensure it maintains it’s value. One threat to letting agency valuations is the rise of regulation and enforcement weakening buyer confidence and raising the question of unidentified risks in the portfolio.

Yet, whilst the number of buyers for residential sales business has dropped since Brexit, the number for letting businesses has remained stable. Recent figures suggest that established businesses with most of its properties under full management can sell for at least 1.5 times turnover, but what’s the secret to maximising this valuation? In this article we discuss some of the key steps every agency should take to sell their business for the maximum possible amount.

To get the best valuation for your lettings business, you need to

- Do your due diligence

- Differentiate your revenue base

- Use compliance as your competitive advantage

- Due diligence

The first thing to do when looking to sell your agency is carry out full internal due diligence. This means measuring the level of compliance, identifying non-compliance and therefore risks of fines, and taking steps to reduce this. Whilst this can be time consuming, it does help minimise renegotiation in later stages when buyers use potential risk as a reason to reduce price, or in the worst case, for dropping out of a sale altogether. It is therefore an important first step to take to show an acquirer that everything is in order, including client contracts, accounting records and management figures. Proving due diligence has been done does boost the valuation of your business.

- Differentiate your revenue base

Buyers will always favour businesses that have differentiated their revenue base, as they are not reliant on a limited number of revenue streams to stay competitive, or even stay in business. By differentiating your revenue base, you can show potential buyers that they are buying a well managed, innovative business with fewer risks.

Similarly, by sweating your assets and getting as much value out of your current clients as possible, you can show buyers your agency’s growth potential. For example, by introducing Kamma’s Licensing Application service, agents can make up to £600 per licence application service made by their landlords and clients, and in this way profit from their compliance. A portfolio of just 200 properties can expect to throw up around 50 that need a licence, offering a recurring revenue opportunity of £30,000 that boosts agency valuation.

3. Compliance drive value for acquisitions

A buyer is more likely to be interested in acquiring a business that has no history with fines or non-compliance, as well as having the tools in place to safeguard their business against future risks of non-compliance.

Compliance can therefore be linked to your competitive advantage and increase the value of your business compared to other agencies. Especially if you deploy licensing compliance technology that eliminates any manual errors and mishaps when it comes to property licensing and MEES. A tech-led approach ensures minimal non-compliance with maximum operational efficiency, ensuring buyers that not only is the portfolio secure, but that it will stay that way without a large operational cost. Solving this major pain point ahead of acquisition smooths the buying process.

It is the businesses that can differentiate their revenue base, effectively manage their regulatory risks, and focus on their due diligence that stands to get the best valuation for their agency. That’s precisely why the business owners that plan for the future and nurture their business by not just seeing it as an asset, but also an investment, that will get the most successful sale outcome.

New insights: how does EPC data impact affordability assessments?

Accurate energy performance data is a must to ensure mortgage lenders can accurately assess affordability and reduce risk – here’s why.

Read more

Kamma’s Response to CVE-2024-0394 (XZ Utils Backdoor)

Last week security researchers publicised a malicious back door in the XZ Utils library, a widely used suite of software that gives developers lossless compression and is commonly used for compressing software releases and Linux kernel images. The backdoor could, under certain circumstances be used to run unauthorised code via the encrypted SSH connection protocol. […]

Read more

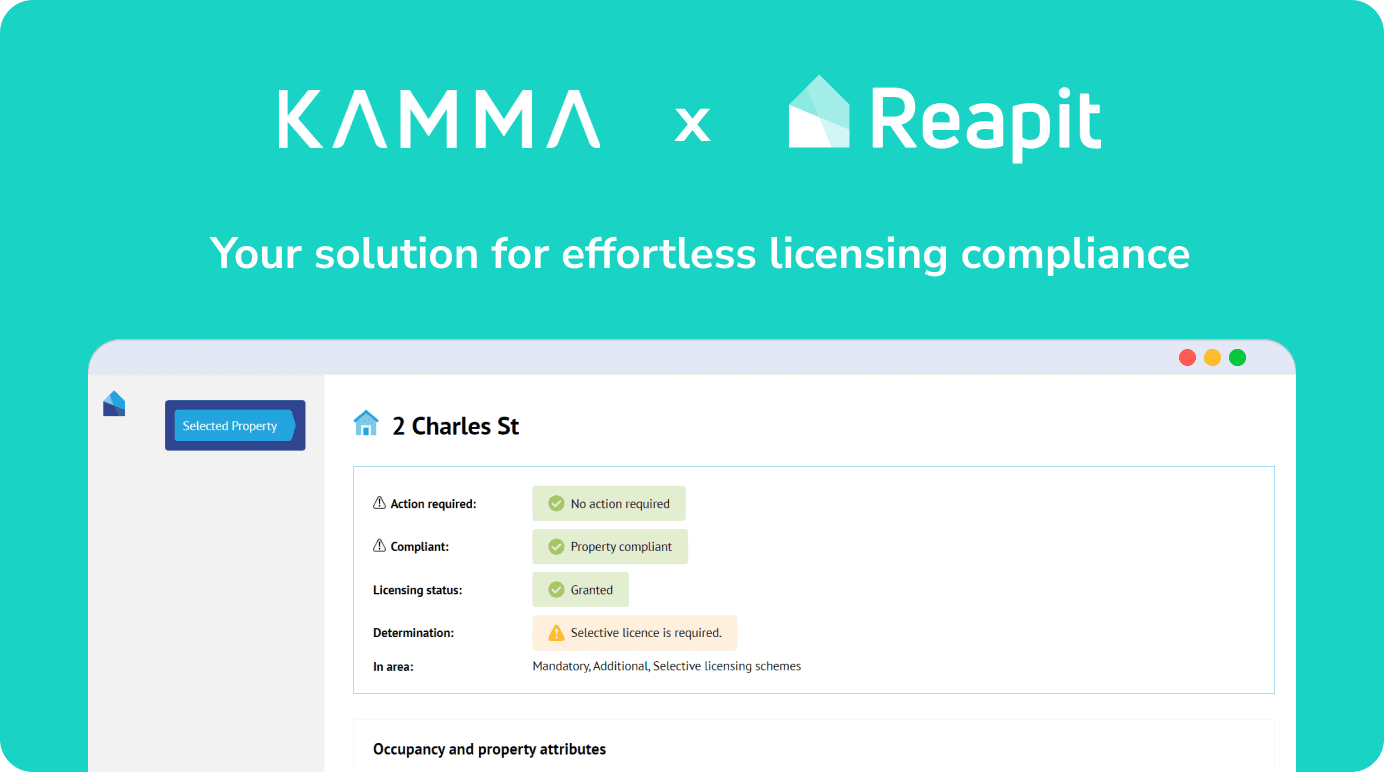

Licensing Compliance Simplified: The Kamma-Reapit Integration

The Kamma app is officially live on the Reapit marketplace! This integration arrives just in time to confront the introduction of fifteen new licensing schemes and six current consultations in the first half of the year alone. Kamma’s Reapit integration empowers you to effortlessly manage your licensing compliance through: How does the app work with […]

Read more

Subscribe to the Kamma Newsletters

Regular news, information and insights from Kamma. No spam. Unsubscribe at any time.

Subscribing ...

Sorry, we really want to but we couldn't subscribe you due to missing or incorrect information; please update the information that's highlighted in red and try again.

Well this is awkward. Something went wrong on the internet between your browser and our newletter subscription service. Please let us know and we'll do our best to fix it for you.

Thanks for subscribing! Check your Inbox in a short while for a confirmation email to check it was really you that just subscribed. If you've already subscribed, we'll keep your subscription but you won't receive a confirmation email this time.