- What we do What we do

- How we can help How we can help

- Insights Insights

- About About

- Support Support

- Book a Demo

A MEEStake waiting to happen

Passing on the cost of the Bill: New government policy could hand landlords a £29 billion energy efficiency cost, little support, and easy ways to avoid it

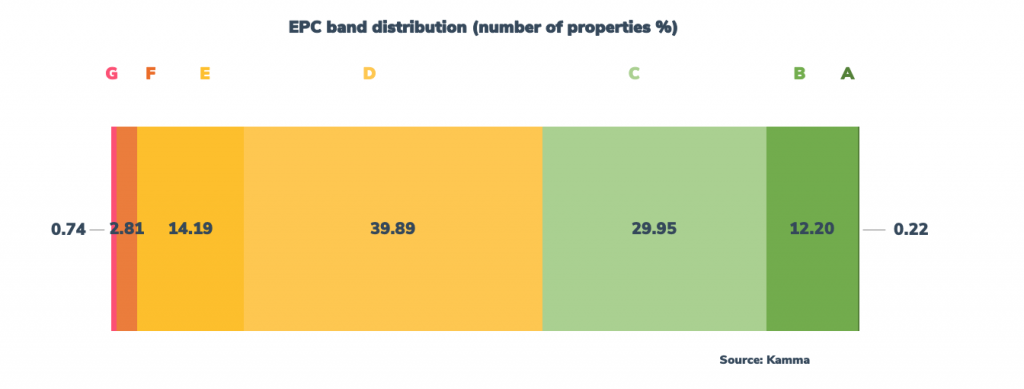

The path to Net Zero for UK property demands a switch to renewable sources and a substantial increase in energy efficiency. As many properties as possible need to achieve an EPC rating of A by 2050 and yet, based on the latest available EPC data, just 0.21% do so. With urgent action required, earlier this year the BEIS proposed an interim target: to increase the Minimum Energy Efficiency Standard (MEES) of rental properties from a rating of E, to a C in England and Wales. Last month we saw the first reading of the Bill, which would enact this proposal into law, pass through parliament.

The latest EPC data, analysed by Kamma highlights that, with 58% of registered properties at grade D or below, this represents a huge financial investment for the Private Rented Sector (PRS). With 2.9 million homes needing to improve, and an estimated average cost of £9,872 per home, landlords need to invest an estimated £29 billion to achieve this target, and to do so against an accelerated timetable. Yet with a long list of exemptions available any policy could be rendered functionally useless before it’s even passed into law. With a high cost of action and a higher cost of inaction, a nuanced and sophisticated approach is required. Either loopholes need to be closed and funding routes identified, or a phased timetable should be introduced that targets lower hanging fruit as a first priority.

Energy efficiency in conservation areas

One of the first challenges to solve is in conservation areas, where some local authorities are much more aggressive in protecting the style of home rather than its emissions. One example of this that recently made headlines in the media, is a buy-to-let landlord in Portsmouth. With an expected MEES of EPC Band C to be introduced by the end of 2025, the landlord proactively installed new triple-glazed windows to improve the property’s energy efficiency and yet was later served with a council order to remove the new windows due to conservation regulations in the area. The property’s EPC grade will drop from band C to band E when the single-glazed windows are reinstalled, leaving him with huge costs, and concerns that he will not be allowed to lease the property under the government’s new MEES regulations.

Clear, consistent policy is needed at both the central and local government level. Yet with few rental properties currently within conservation areas, the overall impact on the path to Net Zero could be limited. It’s the more expansive PRS exemptions policy that could cause more of a problem to both landlords and green campaigners alike.

The PRS exemptions putting a hole in policy

Putting aside general exemptions, such as those seen on listed buildings, domestic private rental properties can register themselves exempt based on any of the following:

- High costs – where the cheapest improvement exceeds £3,500

- All improvements made – where all possible improvements have already been made with a cost cap of £3,500

- Wall insulation exemption – where the specific type of wall insulation is not suitable

- Consent exemption – where consent from a third party, such as from a local authority planning office or freeholder, is required

- Devaluation exemption – where the improvement may lead to a decrease in value

- New landlord exemption – a 6 month grace period where an individual has become a landlord ‘suddenly’ or if a property purchased was already tenanted

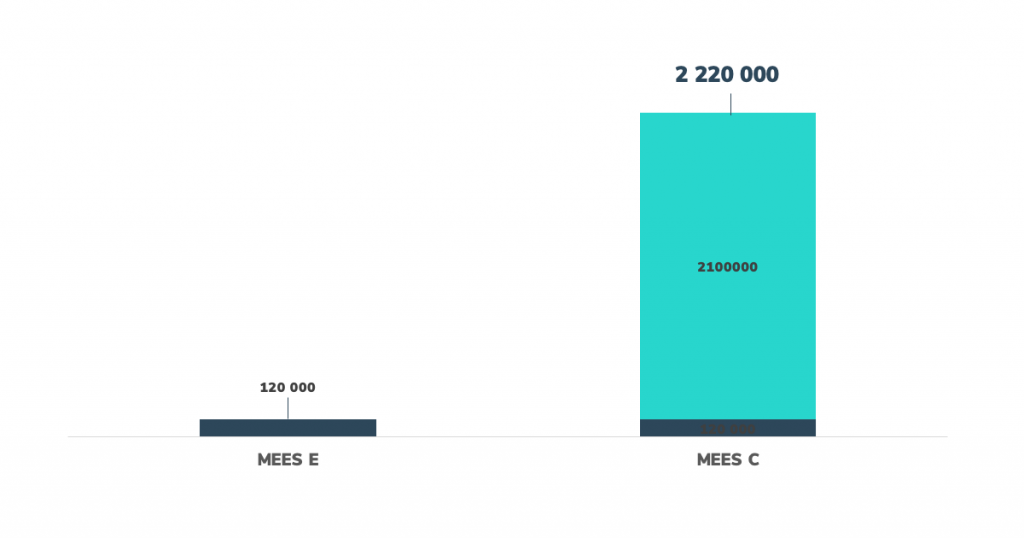

Based on existing exemption standards, this creates huge loopholes in the government’s policy. Landlords under the current minimum rating of E need to invest only up to a maximum of £3,500, which means 120,000 rental properties can still be let out despite being below an E rating. Similarly the ‘all improvements made’ exemption qualifies an additional 1,000 that have run out of viable upgrades. The obvious challenge is that both these categories of exemption will cover far more properties as the MEES is raised. The increased cost associated with increased targets means an additional 2.1 million properties could qualify as exempt, or a staggering 73% of the PRS.

Number of properties that qualify as exempt in England and Wales under new MEES

Scaling a solution or scaling a problem?

The main limiting factor on the number of exempt properties is the relatively low proportion that are currently EPC grade F or G. But what happens if the minimum standard changes to a C rating? This will require the improvement of far more rental properties, naturally leading to far more being able to qualify as exempt based on existing exemption standards.

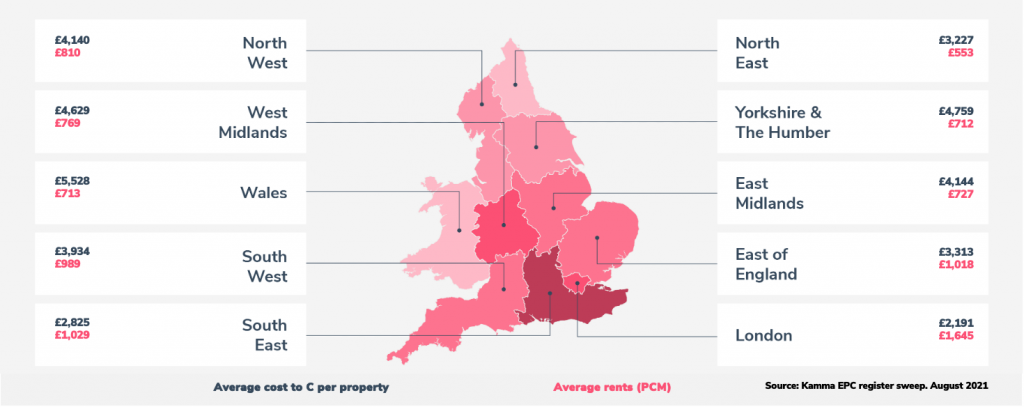

The biggest impact may fall under the £3,500 spend cap exemption. Improving so many homes to such a large extent will bring greater cost, thereby qualifying more properties for exempt status. Getting to EPC C is an expensive undertaking, and our analysis estimates an average cost of £9,872 per home. To put it another way, the average property in England would currently register themselves as exempt at least two-times over, if exemptions remain in their current form.

One proposal is to raise the maximum investment to £10,000, to fully cover costs. But herein lies the central paradox of the government’s current position. Upgrading UK housing stock from where it is, to where it needs to be, is undoubtedly an expensive exercise. With both a high cost of action and a higher cost of inaction, it seems clear that the sector desperately needs investment. Yet by removing support in the form of the Green Homes Grant, and raising standards at the same time, they are leaving the sector with a huge bill to pay in an era when tax changes have already hit landlords hard. If the policy is to make landlords foot the bill for these upgrades, then why penalise those in-line with the national average of EPC grade D with a cheaper route to C, whilst also allowing some of the most inefficient homes in the country to stay as they are on the grounds of ‘high cost’?

Regional disparities

As of now, there are around 8,500 properties across England and Wales registered as exempt from having to install energy efficient improvements. But what will happen when MEES changes to EPC C in 2025?

As we explore in more detail in another report, there are already huge regional disparities of energy efficiency ratings across England and Wales where the North West, Wales and Yorkshire and The Humber are lagging behind. According to our previous analysis the North West will not have an average EPC of C until 2061 – which is around 30 years after London and the South East. This adds a huge affordability question as those regions with lower yields and lower rents, will nevertheless end up with a bigger bill to pay. Just as landlords spending £9,000 may question those with a £10,000 bill that don’t have to pay, those in the North West may query why the cost of compliance is so much higher in their region when yields are so much lower.

Unlocking the capital required

There is a solution for this. As we discuss in more depth in another report there is a huge opportunity for lenders to securitise their green assets (as RMBS) and reinvest the proceeds to help landlords improve their properties EPC rating. In this way, landlords previously deemed exempt can get access to cheaper capital needed to carry out energy efficient improvements on their properties. Allied to the progressive policy on tax put forward by the NRLA, and grants for those most at risk, the green revolution needed for UK property could actually be sparked. For that to happen the government needs to work out a clear pathway to Net Zero for UK property, and who is footing the bill. If it is to be landlords, then a fairer and phased approach may be needed, one that takes into account not just current property efficiency, but the opportunity to improve and the ability each landlord has to pay.

For more information on our MEES analysis see our press release

How EPC data impacts property valuation for mortgage lenders

Reliable and up-to-date energy efficiency data is a must to ensure an accurate property valuation for UK mortgage lenders – here’s why.

Read more

New insights: how does EPC data impact affordability assessments?

Accurate energy performance data is a must to ensure mortgage lenders can accurately assess affordability and reduce risk – here’s why.

Read more

Kamma’s Response to CVE-2024-0394 (XZ Utils Backdoor)

Last week security researchers publicised a malicious back door in the XZ Utils library, a widely used suite of software that gives developers lossless compression and is commonly used for compressing software releases and Linux kernel images. The backdoor could, under certain circumstances be used to run unauthorised code via the encrypted SSH connection protocol. […]

Read more

Subscribe to the Kamma Newsletters

Regular news, information and insights from Kamma. No spam. Unsubscribe at any time.

Subscribing ...

Sorry, we really want to but we couldn't subscribe you due to missing or incorrect information; please update the information that's highlighted in red and try again.

Well this is awkward. Something went wrong on the internet between your browser and our newletter subscription service. Please let us know and we'll do our best to fix it for you.

Thanks for subscribing! Check your Inbox in a short while for a confirmation email to check it was really you that just subscribed. If you've already subscribed, we'll keep your subscription but you won't receive a confirmation email this time.