- What we do What we do

- How we can help How we can help

- Insights Insights

- About About

- Support Support

- Book a Demo

Kickstarting a Green Funding Revolution

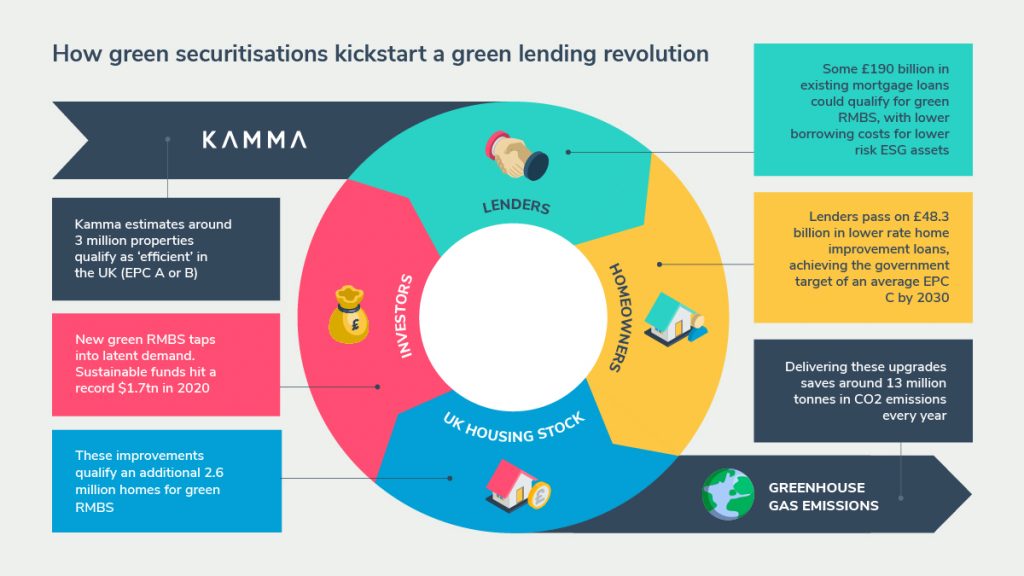

Green Securitisations (green RMBS) are worth an estimated £190 billion in the UK, providing the critical funds needed to improve household energy efficiency

- Existing mortgage loans on EPC grade A and B properties have been analysed in a report by geospatial technology company Kamma, who estimate 3 million homes and £190 billion in existing loans could qualify for green securitisation

- Challenges with qualifying properties as “green” have prevented RMBS from enjoying the dramatic growth seen in ESG investment globally, which increased by 96% in the last year to £288 billion

- Previous government proposals result in a £48.3 funding gap for the private sector to fill, with mortgage lenders asked to deliver an average EPC grade C by 2030. Green securitisations provide the vehicle to fund this, saving 13 million tonnes in annual CO2 emissions in the process.

24th June, London. Green securitisations on homes that have achieved an EPC grade A and B could offer a recapitalisation opportunity to the tune of £190 billion, according to a report by geospatial technology company, Kamma.

Government targets for improving UK property suffer from a major gap in funding, yet green securitisations could more than cover this gap, unleashing a green funding revolution in the UK marketplace.

The UK government, hosts of COP26 later this year in Glasgow, have set the most ambitious climate targets in the world: to reduce emissions by 78% by 2035. UK property contributes 22% of total emissions, yet the end of the Green Homes Grant scheme leaves no clear solution or roadmap for improving household energy efficiency and reducing emissions.

Government proposals so far have pointed to an increased role for the private sector, with mortgage lenders set to take increased responsibility for delivering an average EPC grade C by 2030. As Kamma has previously reported, in England and Wales alone this creates a bill to the tune of £48.3 billion, with no clear indication of who is picking up the tab.

Kamma CEO, Orla Shields said:

“Hosting the UN’s Climate Change Summit is putting yet more pressure on the UK government to lead the way in their commitment to fighting climate change. So far, they’ve only set targets and laid out the scale of the challenge. In the search for solutions, we believe the time is now for green RMBS.”

Recent market data shows a dramatic increase in the popularity of green investments, which grew by 96% last year to some £288 billion globally. Shields continued:

“This is no longer just about investors supporting sustainability goals. With a wave of new regulation about to hit the UK market, consumer sentiment and spending favouring green brands and an increase in ESG investment, banks are starting to wake up to the financial, as well as environmental, benefits of ESG products. Proposed regulations for the UK housing market, for example, could dramatically alter the value of energy inefficient homes. Greener investments are becoming the more profitable investments.”

Kamma points to the world-leading example of the Dutch bank Obvion, who double qualify their green securitisations with both green underlying assets and green use of proceeds. Directing their re-capitalised funds into green loans qualified another wave of homes for green RMBS, creating a virtuous circle of green lending. Repeating this at a UK market level would create a revolution in green investing and funding available. A favourable market, with investors paying a premium for better performing sustainable assets, incentivises mortgage lenders to offer green RMBS, thereby increasing lending and lowering interest rates on energy efficient homes. In turn, this incentivises property owners to reduce emissions, creating a virtuous circle that accelerates the transition to a greener world.

Orla Shields concluded:

“Securitising around a quarter of the £190 billion available could supply the funding needed to meet the government’s target of an EPC grade C in homes in England & Wales. This in turn would qualify a further 2.6 million homes for green securitisation, tapping into the green investment market and providing yet more funds for the green revolution that UK housing desperately needs.”

New insights: how does EPC data impact affordability assessments?

Accurate energy performance data is a must to ensure mortgage lenders can accurately assess affordability and reduce risk – here’s why.

Read more

Kamma’s Response to CVE-2024-0394 (XZ Utils Backdoor)

Last week security researchers publicised a malicious back door in the XZ Utils library, a widely used suite of software that gives developers lossless compression and is commonly used for compressing software releases and Linux kernel images. The backdoor could, under certain circumstances be used to run unauthorised code via the encrypted SSH connection protocol. […]

Read more

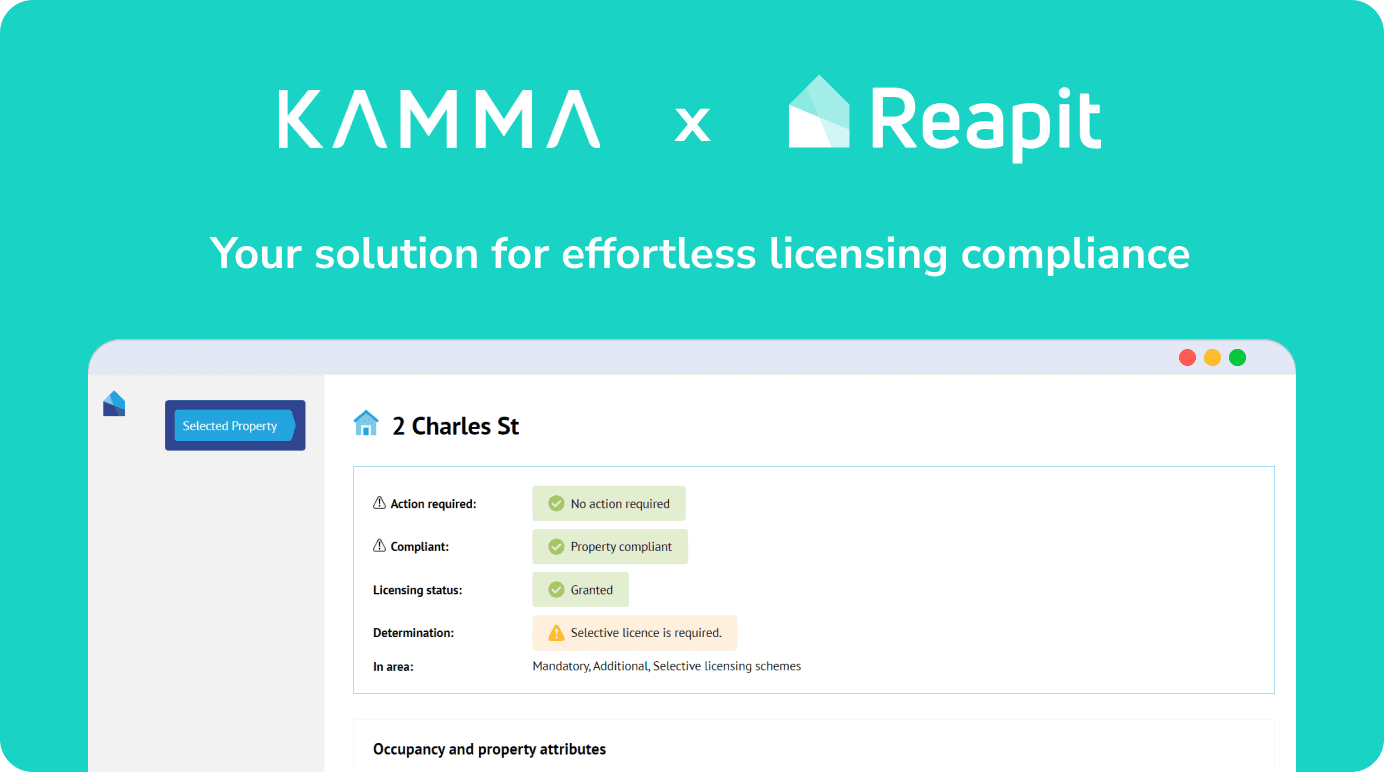

Licensing Compliance Simplified: The Kamma-Reapit Integration

The Kamma app is officially live on the Reapit marketplace! This integration arrives just in time to confront the introduction of fifteen new licensing schemes and six current consultations in the first half of the year alone. Kamma’s Reapit integration empowers you to effortlessly manage your licensing compliance through: How does the app work with […]

Read more

Subscribe to the Kamma Newsletters

Regular news, information and insights from Kamma. No spam. Unsubscribe at any time.

Subscribing ...

Sorry, we really want to but we couldn't subscribe you due to missing or incorrect information; please update the information that's highlighted in red and try again.

Well this is awkward. Something went wrong on the internet between your browser and our newletter subscription service. Please let us know and we'll do our best to fix it for you.

Thanks for subscribing! Check your Inbox in a short while for a confirmation email to check it was really you that just subscribed. If you've already subscribed, we'll keep your subscription but you won't receive a confirmation email this time.